Lots of people dream about creating a business… but what about buying one?

When it comes to startups, there are plenty of downsides:

- Tons of work — long hours, high stress, and starting from zero

- Low pay: Many founders are on the ramen noodles diet in the early years

- 80% rate of failure (all that hard work for nothing)

Jonathan Siegel, the author of The San Francisco Fallacy, thinks starting a business is overrated.

This is why Jonathan has bought 29 companies.

In this post, you’ll learn:

- How the hell Jonathan has bought 29 companies

- Jonathan’s philosophy on hiring — and why he DOESN’T go after traditional “A” players

- Why adjusting pricing is the QUICKEST way to 2x your business

went on to start Intercom).

The company had a few customers and was making about $3,000 per month. Jonathan brought the company for $250,000 (paid over 30 months) and began to make small tweaks, starting with pricing.

When acquiring a company, Jonathan will only focus on companies he knows he can improve. He looks for 5 main elements:

- Revenues flat or going up slowly — never trending down

- SaaS products

- Not doing any marketing (or doing very little marketing)

I’ve learned to focus on similar high-leverage items — and ignore the rest — while building my 8-figure business Sumo.

- Reposition the company: You can buy a company and reposition it within the market. For example, imagine you purchase a SaaS company selling their product for a one-off fee. You could change the pricing to be a monthly subscription and grow the company through recurring revenue.

- Spend money: By spending money smartly, you could 10x the company by hiring an epic team or investing in proven marketing strategies. More users = more money = you can sell the business for more than you paid.

- Add value: Create more value within the company with additional features, products, or services. One of my favorite ways to grow a business is launching new complementary products that already have a proven market need

It’s possible for you to use these ideas to grow your business too. Don’t let the wantrepreneur mindset pull you off track.

| BONUS: 7 marketing tools I’ve used to grow multiple 7+ figure businesses |

2. Why Jonathan DOESN’T hire traditional “A” players

When you’re buying a business, you need a great team.

But most companies hire crap employees… even if they say they’re A players!

Hiring A players can be challenging. It’s something I’ve had to work hard to learn over the past few years for my business Sumo + AppSumo.

Avoid them completely!

Instead of obsessing over hiring the people who work at Google or Facebook, look for market inefficiencies in the hiring world.

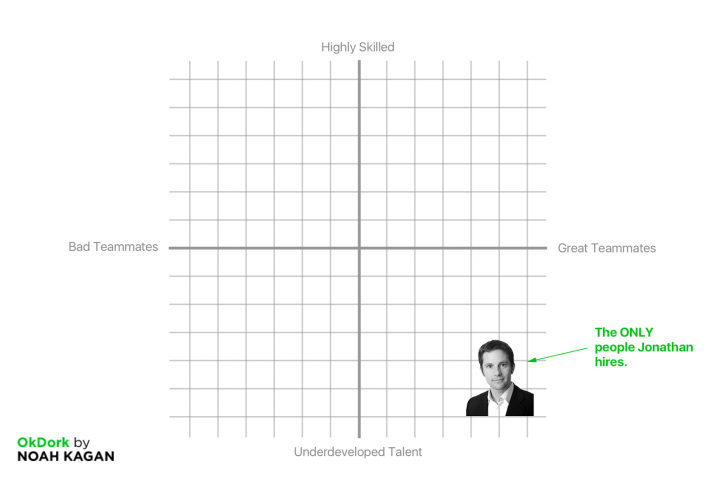

Jonathan thinks of hiring like a quadrant to take advantage of weaknesses in the market.

On the y-axis you have highly skilled workers and underdeveloped talent. On the x-asis you have great teammates and bad teammates.

Jonathan eliminates three sections of the quadrant:

- Bottom left: You don’t want to hire the people who are awful coworkers and don’t have the skills.

- Upper left: People who are highly skilled and bad teammates might seem like a good hire at first because of their skillset… but they poison a team. As Jonathan says, they’re better consultants or temporary hires to fix a major business problem (and then get the f out)

- Upper right: Because they’re damn expensive, Jonathan knows he’ll never get these people. 🏦👋😢

This leaves great teammates with underdeveloped talent.

“I hire them every single time,” Jonathan explained.

For example, when Jonathan hired his right-hand woman, Teri, she’d just returned from the Peace Corps.

Teri didn’t know:

- How to use an iPhone

- What Twitter was

- “Correct” business practices

But Jonathan loved her attitude and thought he could teach her how to be successful in business.

She’s ROCKED it. Today, she’s Jonathan’s director of operations. 🚀

Great teammates who don’t have the talent yet are diamonds in the rough:

- They have great attitudes so they can learn quickly

- They’re fun to be around

- They make other team members happy

Focus on market inefficiencies to hire teammates other people undervalue.

Sumo, we’ve changed pricing 7 times in a few years.

We started 100% free. Then, we played around with a bunch of different variations until we hit the pricing point that’s just right (for now).

These pricing changes were a big part of our journey to become an 8-figure company.

| Want more ways to 2x (or more) your business? |

Most entrepreneurs totally mess up their pricing.

They…

- Take a random guess

- Look at their competitors

- Throw a number against a wall

If you do this, you’re potentially leaving tons of money on the table.

Changing price is the easiest win for a young company to GROW.

When Jonathan acquired one company, the product was being sold for a one-off fee of $5.

Through pricing experiments, Jonathan managed to increase the pricing to $9 a month before sign-ups fell off.

Money in the BANK. 💰💰💰

Once you’ve found the right pricing structure, you can also start to invest more in marketing to increase revenue.

This means you could test a bunch of marketing tactics:

- Content marketing (our #1 focus at Sumo)

- Facebook Ads

- Maybe even launch a podcast

When you find a marketing channel that works, go all-in. And squeeze all you can from the channel using the Content Multiplication formula!

Here are 5 key lessons from Jonathan buying 29 businesses…

- You don’t have to start a business — buying a business is a LEGIT way to be successful.

- There are 3 key ways to make money in a business: Repositioning the business, restructuring the finances, and create additional value.

- Great teammates who have underdeveloped talent are diamonds in the rough.

- The best way to 2x your revenue quickly is to increase your pricing.

- You should ALWAYS be speaking with your customers to understand their needs.

Want more lessons from Jonathan Siegel — the entrepreneur who’s bought 29 freakin’ companies?

Check out the full episode below.

24 responses to “How to 2x Your Business This Year: Lessons from Buying 29 Companies”

The role of a business lawyer and an accountant can never be taken for granted, when it comes to buying a business. When you are buying a business, make sure you are purchasing the assets, not the business. A “Letter of intent which is known as term sheet” must be there. You can negotiate it. But you can’t overlook it. You will find a common misconception when buying a business i.e a founder is selling a business means, there must be something wrong with it. You should ignore that myth completely. You have to decide what you are looking for – I think this is the most important thing that a buyer needs to do. Purchasing a calling is an overwhelming affair. To make it less intimidating, you should appoint a certified business broker- https://pghbizforsale.com/about-us/ .

I come back to this episode all the time. One of your best

I’ve listened to this episode twice now and will probably give it another listen in a month.

The best practice tactics are brilliant – it’s easy to say oh yeah I know that, but have them laid out and discussed this way really focuses your attention on the levers that can drive quick growth.

Thanks Jonathan for opening up and sharing so much!

This one cracked me up. Thanks Noah.

Really enjoyed this podcast, actually I’ve enjoyed most of the podcasts, but their pure volume numbers have just decreased in the recent time. I know this is probably not the biggest ROI activity on your checklist, but I don’t mind if we’d have a part 2 for this one, since there’s more real talk than bs talk, which you can spot when the host is not interested or the guest tries all his tricks to just go for the sell.

Keep up the great work.

//Felix

Loved this article Noah.

Though, Jonathan talks about not hiring the “A” team, but the “B-C” team and making them into an “A” Team.

I’m not going to say, finding this team is easy. But finding this type of company or individual seems harder.

It feels like they fly under the radar.

Suggestions in how you would track down these types of companies/individuals?

And this is open to the group/other commenters if you have suggestions.

Great guest. Inspiring story. Counterintuitive, but good advice about hiring. A bit like the position that sports general managers are in: do you build your team through the draft, or through free agency? If you don’t have a huge budget, you can’t afford to pay for the best “free agents” – the only option is to take unproven, undeveloped talent and to make them better.

One thing I would have liked to hear more about: 8 kids? Seriously? What kind of systems does he have in place to avoid total insanity?

Nice work.

Wow, this was a great one. Noah, love the way you ask questions. Simple, straight to the “how the heck does that work”.

Ps:

“for more than you brought it.” – is this a typo or is my English getting worse? 🙂

Brilliant. I buy lots of companies never learned some killer ideas. Great point about chasing non sexy meat and potato million dollar businesses that are not utilizing the tools to optimize. Guess I need to find some SaaS companies.

The best part of this interview was the 99% of best practices that most businesses aren’t doing in their marketing. Pure gold, and here they are:

– testing adwords

– email marketing

– blogging regularly

– going to events

– forming partnerships

– doing 5 minute callbacks whenever they get a new lead on the website.

– try 6 times to reach new inbound leads

– if you do this, it is 99% of the best practices. And most companies don’t do it.

– usually they’ll try one thing, and they’ll do it bad. They’ll do Google AdWords, but they won’t optimise it right, so they’re way overpaying. Or they’ll run a landing page, but they won’t A/B test it, so they’re conversion rates are really bad.

– or they’ll get sales opportunities and they won’t call them back within 5 minutes. It’s known that if you don’t call them back within 5 minutes then you’ll see a precipitous drop off in the ability to contact that customer.

Thanks Noah, Jonathan, and those who put all this together.

I’d work for that guy…love the quadrant idea!

I really wanted to hear more from the conversation. I wanted to hear how he finds the business, how he vets them from listing, to brokers, to owners, etc. I’d really like a podcast about how to buy (or sell) an under 5 million annual business and get the curtain pulled back on that.

Ever since the NPR podcast, you’ve really upped your editing game- but you always leave me wanting a little more details from the conversation; I don’t know if thats the goal. But before NPR I’d get a little bored, now I’m really engaged, but never really satisfied with how the endings happened; I’d like more rabbit trails.

Agreed. There needs to be a part 2. Thanks for listening. Give the people what they want, Noah! You’re always asking for feedback, right? So yeah a part 2 would be a good one for sure.

Same questions as Scott: finding biz, vetting etc. Deeper on the buying side of things.

How do you assess risk of product becoming outdated, or run out by a huge competitor? (e.g. Facebook getting into website chat may significantly hurt other chat products)

Such a great interview for many reasons. Noah, you’re such an out of the box thinker and when you made the comment “this makes it sound too easy” he brought the thinking out of traditional thinking on company development to a whole different arena, quadrant perhaps (btw, this is fascinating, https://okdork.com/wp-content/uploads/okdork-blog-jonathan-siegel-hiring-chart-e1503359805223.png). It reminded me of the “possibilities” available when you look at things without a fixed way that things are a “certain way.” In rereading what I just wrote, sounds more like a riddle but that plays into how much it’s got my wheels spinning on some stagnant channels in my biz. Nice work Noah/Jonathan, thanks!

Digging this branding.

Clarity of message is everything! (and greatly appreciated)

Great podcast and great info. Will be getting the book but have some questions;

– How do you identify potential employees who have great teamwork abilities? A lot of Cvs’s (pretty much all of them) claim they are good team players? How do you cut through the bullshit?

– Where is a good place to buy SaaS companies? Is it a case of networking or finding brokers?

– Last question, (has to be 3 questions, Muslim thing) do you have an exit strategy for the businesses you purchase? Presuming so as software/tools can become outdated if not innovated within. Or are you in it for the long haul?

I’m the first person to comment hence these questions as a higher chance I might be heard so worth a shot.

Keep doing your thing bro, knowledge is valuable and outlook on business and money expands with your podcasts too 🙂

Shit, I wasn’t first!

“How do you identify potential employees who have great teamwork abilities?”

I would like to get an answer to this as well.

Same questions as #2 & 3… wish someone monitored the comments.

Hopefully another podcast comes from everyone’s show of interest.

Thank you Jonathan & Noah for the great insights and discussion. I’d welcome your suggestions on where to find & sell such businesses.

How do you find a good value company that is up for sale ?

Loved the post. Didn’t have time to listen to the entire podcast, but where does Jonathan look for companies to buy? Are there certain websites are email templates he can share?

Simple Energetic and value offering podcast.Going to listen to this again and read the book too.