Jeff Bezos’ net worth is around $114 billion dollars right now, which isn’t the highest net worth he’s ever had. In previous years, Jeff Bezos has had a net worth of $150 billion, or even $200 billion! But since a lot of his net worth is tied up in his companies, it rises and falls with market fluctuations.

With hundreds of billions of dollars to his name, you might think that Jeff is the richest person in the world right now—right?

Nope!

Elon Musk’s net worth is usually bigger than Jeff Bezos net worth. Again, it depends on market fluctuations.

But net worth is just a number. No matter how the market is doing, Jeff Bezos’s businesses bring in a lot of cash. In this post, I’m going to dive deep into his businesses, how they make money, what they’re doing right, and how Jeff is building his business empire so we can get the full picture behind his net worth.

Let’s dive in.

Join 157,000+ subscribers getting my FREE weekly business tips

Jeff Bezos Net Worth: How He Built the Amazon Empire

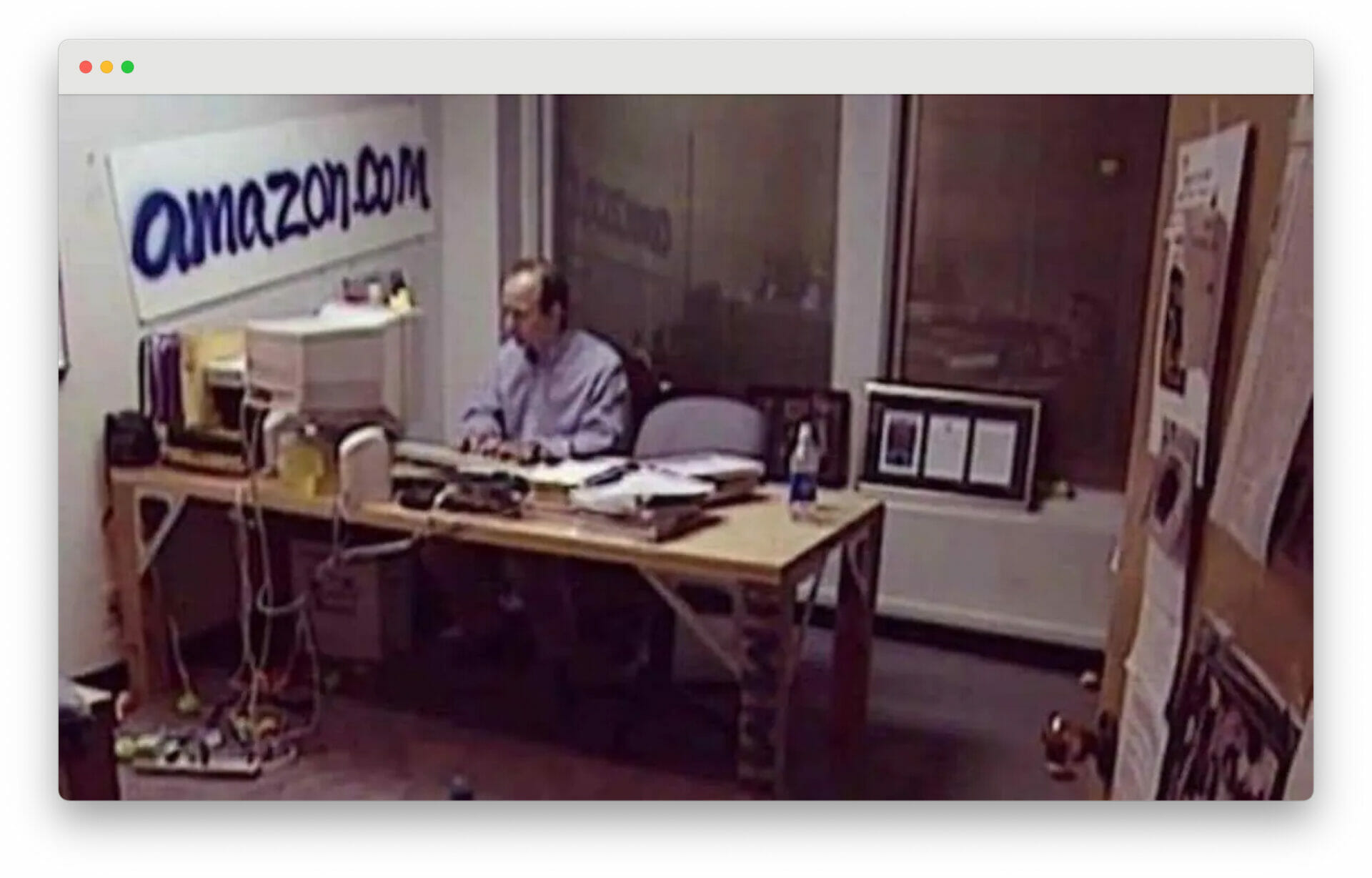

Everyone knows the story that Amazon started in a garage…

It’s a romanticized trope that startup culture loves to spread far and wide: Look at Amazon! The BILLION-dollar company started in a garage! If Jeff Bezos can do it, you can too!

The last part is true. If Jeff can do it, you can do it too.

But it’s worth remembering that the journey to create Amazon didn’t come without some help and hiccups along the way.

Which is a great lesson in itself. As entrepreneurs, we can’t do it alone.

These are some of the milestones that helped make—and almost break—Amazon along the way:

- Jeff had a feeling that the internet was going to be very popular, so he pitched the idea of starting an online bookstore to his boss

- His boss said no, so in 1994, Jeff left his hedge fund job to start Amazon

- His parents invested $300,000 to help Amazon get started

- 3 years later, in 1997, Amazon went on the stock market with an IPO of $18 per share

- Another 3 years later, cash flow was drying up, so Jeff borrowed $2 billion dollars from the banks

- And a couple years after that, the company was going through a tough time and almost went bankrupt

- In the last quarter of 2001, Amazon finally turned its first profit. The profit margin was 1 cent per share, and the company had about $1 Billion in revenue that year

So even though Amazon’s humble beginnings started in a garage, the full picture shows a bit of a different story. The cash injection from his parents helped start the company off on a strong foot, and a quick three years to IPO meant the company could rake in even more money to fund further growth.

Even with help, it still took Amazon 7 years to turn its first profit!

SEVEN years.

A lot of entrepreneurs I see will give up in less than 7 months if they don’t see a profit.

MANY companies are not profitable when they first start. It doesn’t mean that the company isn’t making any money, it means that the money is being put back into the business to grow and expand it.

Jeff clearly started Amazon with growth in mind.

It started as a bookstore, but he always planned to turn it into an ‘Everything Store.’ To achieve that growth, he had to put a lot of cash into the company in the first few years to create a worldwide operation.

Key Takeaways from Amazon’s Growth

There’s a few choices Amazon has made along the way to stay relevant over the years and come out on top.

The great news is, most businesses can do these things. Or at least, learn from these lessons and make similar choices to always be improving their business.

Here’s what Jeff did to put and keep Amazon on the map:

- Took advantage of a growing market: Jeff knew that the internet would take over traditional retail, so he bet on it. Keep an eye out for emerging markets and technologies and be an early adopter.

- Saw the big picture: He started Amazon as a bookstore, but always planned to sell other types of products. Don’t get stuck on trying to make one thing work. Pivot until you find what’s REALLY working.

- Put Amazon first: He LITERALLY put Amazon first. The original name of the company was Cadabra, but websites back then were listed in alphabetical order, so he renamed it to Amazon so it would show up first.

- Underpromised and over-delivered: He accepted cash injections from his family and other early investors, but cautioned them that there was a 70% chance Amazon would fail or go bankrupt.

- Became a big fish by “eating” smaller fish: Jeff didn’t try to create everything on his own. He used Amazon’s growth to acquire smaller companies so they could expand the reach and capabilities of what Amazon could do. As Amazon got bigger and bigger, it was able to acquire bigger companies (like Whole Foods) which compounded expansion growth. Start small, so you can eventually get big.

- Doesn’t stay stuck in the past: Amazon successfully expanded into new markets and product categories over the years like ebooks, cloud computing, video and audio streaming, and digital advertising. Diversifying helped the company continue to grow and stay competitive in a crowded online world.

Jeff Bezos’s Other Businesses

Even though Jeff isn’t the CEO of Amazon anymore and doesn’t run the day-to-day stuff happening at the office, he still makes a lot of money from the company as a shareholder (he still owns 10% of the company).

But besides the net worth Jeff Bezos accumulates from Amazon, his total wealth is not just the result of Amazon’s success.

He owns and operates a few other companies, which contribute to his overall net worth as well. But, since these companies are privately held, we can’t know for sure how much he makes from them.

But for interest’s sake, let’s dive in.

Revenue Stream #1: Blue Origin

Since Blue Origin is a space exploration company, there’s a lot of risks associated with it.

The company’s goal is to develop technologies that will enable human beings to live and work in space. It’s currently focused on a bunch of projects, like the New Shepard spacecraft and the Blue Moon lunar lander.

Just like how Amazon wasn’t profitable in the beginning because a ton of money was being reinvested back into the company to grow and expand it, that’s probably what Jeff is doing with Blue Origin today.

Right now, it’s not necessarily meant to generate income. It’s meant to be innovative.

In 2018, Jeff announced that he would sell $1 billion worth of Amazon stock EACH YEAR to fund Blue Origin’s operations. So he’s clearly investing a significant amount of resources into the development.

Revenue Stream #2: The Washington Post

Like Blue Origin, The Washington Post is also a privately held company, so we can’t know for sure how much money Jeff makes from it.

He bought it in 2013 for $250 million, and the company has likely generated significant revenue and profits since then.

Since he bought it, Jeff has focused on expanding the newspaper’s online presence which has expanded its reach and influence. With an online presence also comes online advertising, which has likely helped bring in a lot of revenue and profit for the paper.

Revenue Stream #3: Bezos Expeditions

Bezos Expeditions is Jeff’s personal venture capital firm, and it invests in a variety of startups and established companies.

He started it in 1998, and it has made a number of successful investments over the years. Some of the companies Jeff has invested in through Bezos Expeditions include Google, Twitter, and Airbnb.

These investments have likely generated BIG returns, and have definitely boosted Jeff Bezos net worth.

Plus, Bezos Expeditions also invests in charitable causes. In 2018, Bezos and his former wife MacKenzie announced that they would donate $2 billion to charitable causes through Bezos Expeditions.

This philanthropic activity is likely to have had a positive impact not only on Jeff’s public image, but on his overall net worth, too.

Join 157,000+ subscribers getting my FREE weekly business tips

One response to “Jeff Bezos Net Worth: How He Makes Billions (Not ALL From Amazon)”

Wow, that so good or him, one day I am gonna be like him