This email is from THIS video

When I started AppSumo, my goal was to make $3,000/mo.

That way, I could work on the beaches of Thailand while doing work that I WANTED to do. In my first year, I brought in $0 for myself.

Last year, I brought in $3.3m in income (It’s insane to even say that number out loud 😳).

For a long time, it felt like success was right around the corner but never happening. I got so close to success:

- Rejected by Pre-IPO Google (2x) & Microsoft (1)

- Fired by Facebook

- My company got banned by Facebook

- Started (and failed) 20+ startups

I hesitated to share this breakdown publicly – because I wasn’t sure if it would be well received (and for privacy reasons). But ultimately, I decided to share because if it inspires ONE person to change their life, it’s worth it.

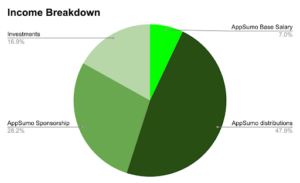

Income Breakdown

Last year, I made $1.7m W2 salaried income from AppSumo (grab some software deals 🤗).

My base salary is $250,000. After we pay for the team, leadership team, Mexico team retreat, ads, and servers – if we still make a profit, my business partner Chad and I get a distribution.

Then, I get $1m from AppSumo to sponsor all the content you see on YouTube and social. I use this to pay my team (but we’ll talk about expenses later).

The last $600,000 I earned is from real estate, equity, and distributions from investments.

I own 2 AirBnBs doing ~$135k each. I have three offices: one I rent to AppSumo, the other two to various parties.

I also invest in several index funds (SPLG, SPDW, SPSM, SPEM) and have some Crypto.

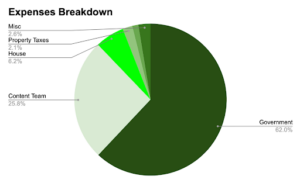

Expenses Breakdown

You can probably guess, the number one expense is Mr. Government (a lady would never be so rude). They take 37% (around $1.2m).

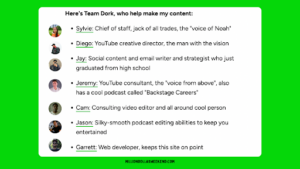

The second expense is the team. As I mentioned above, AppSumo sponsors into an LLC which I use to pay my content team (That’s $500,000 a year for all these beautiful people):

Next, I live in a $2.5m house. The house by itself without water, internet, and cleaning expenses is $120k a year. Property taxes alone are $40,000+ a year.

Note: I’m 10x happier now in a $2.5m home than when I was in a $500k home. I didn’t realize how much your home base impacts your happiness.

I spend around $20-25k/mo on lifestyle stuff (food, clothes, etc.). Then I have insurance, mortgage, wealth advisor (5-figures), bookkeeper (5-figures), food delivery ($500/mo).

So the costs add up as you make more money.

At AppSumo, we have a whole team dedicated to managing every single penny. In my personal life, I prefer not to have budgets or modeling.

Here are 5 takeaways from my income breakdown:

Takeaway #1: Start with your lifestyle

It still blows my mind when I see how much I’m making. And sometimes, I feel self-conscious about it.

But I spoke with a teammate, Taylor, who works in operations management. And he said, “I wouldn’t trade places with you, because the responsibilities you have to deal with to make that money is not what I want.”

Which is a great question to reflect on: What do I really want to spend my days doing?

I LOVE what I do – and one of my goals is to never retire. To this day, I get excited when I see a great deal on software.

One of my friends wants to read books and make podcasts all day. Great! How can you turn that into a business that supports that lifestyle?

Instead of focusing on making the most money, focus on finding work that gets you excited to wake up in the morning. Inevitably, you’ll end up making the most money if you do what you enjoy.

Takeaway #2: Focus on active income

AppSumo started with $50. Last year it made me $1.7m. That’s a 3,399,900% increase (!!)

The mistake I made in the past was spending time on tax optimizations (I even wrote a book about it) when I should have been focused on increasing my active income.

Growing up in a practical environment made me frugal. I hate paying full price for anything… I run a software deal site after all 😂

But no investment, tax optimization, or coupon will get you anywhere close to that return.

To save my mental headspace, I automate my investments. Every month, $10k is automatically invested into index funds. That way, I can focus my time on the things that truly drive the needle forward.

Side note: two things I do splurge on are hiring people and buying the latest technology.

I have an executive assistant, two chiefs of staff, and a personal assistant. They save me a ton of time and peace of mind.

I also always buy the latest laptop. It’s the cheapest investment that can generate you millions.

Takeaway #3: Pay attention to your money relationship

Cliches are cliches for a reason – for the most part, they’re true.

A common saying in business is, “What gets measured gets improved.”

The same goes for your personal finances. Pay attention to your money to grow it. I’ve found there is a direct correlation between monitoring your money and the effort you put into growing it.

Every month for the past 15 years, I’ve tracked my personal finances in a spreadsheet (you can download my template here). I look at how it’s doing and then make a to-do list of next steps.

It’s like looking at a scale and not liking your weight. Once you know better, you can do better.

Takeaway #4: Money only solves money problems

I thought making my first $1m would feel magical. The truth? It was underwhelming. It just went to the bank… and life went on.

The true magic is finding the work you love to do and getting paid to do it.

No amount of money is going to make you feel good about yourself. You’re not going to feel worthy until YOU make yourself feel worthy.

In 2016, I hired Ayman to be the CEO of AppSumo. He crushed it – and took us from $3-4m/year to $60m/year. In those 5 years, I was making $2-3m/year doing pretty much nothing. And I felt guilty because I knew I didn’t earn it.

When I came back to CEO in 2021, It was hard. I was making bad decisions. People were blowing up at me. I was blowing up at them. I was up early. Up late. And even though it was pretty stressful – it made me feel proud because I knew I was earning my money.

Do things that make you feel worthy: go for a walk, read, follow through, be on time.

As I’m getting older, I’m realizing that it’s not about the money, and it never has been. Don’t get me wrong, money is awesome! It helps with so many things. But at the end of the day, it’s about answering these two questions:

- Am I proud of myself?

- Am I spending my time how I want?

Takeaway #5: Wealth is a positive-sum game

Sometimes I see people on YouTube talk about “The Top 1% Earners” and it makes me feel worthy when I’m within that range.

But the reality is I’m not anyone special. The only difference?

- I started – NOW, not HOW

- I kept going – Persistence beats resistance

The two messages I repeat over and over again, because it’s true!

You can have this 100% if you stick with it.

Whatever emotions you have, good or bad. Use them! When I was fired by Facebook – I was SO angry. They were a huge motivation to prove them wrong. Let your hate and discouragement motivate you.

You are the author of your life. Write a great one! 💚

Rooting for you,

Noah 🌮

Ps. I’ve failed A LOT over the years. I want to help you skip my mistakes. In Million Dollar Weekend, I share the playbook to start your 7-figure business in 48 hours. Check it out! 💚

Leave a Reply